Must know media trends

Five of our media experts are here with the trends to keep an eye on in 2024 and beyond...

Author

Ben Cunningham

Date

31.01.2024

1. TV to AV continues

Matt Cumbers

Since the pandemic, TV has dropped in live viewing for all adults by around 3%, meaning it’s more in line with pre-pandemic numbers. Amongst 16-34a, the drop over the past three years has been more significant, 8%. But weekly reach of AV media for this group has only dropped 3%, due to BVOD (Broadcaster VOD e.g. ITVX) and SVOD (Subscription VOD, e.g. Netflix) reach growing YOY.

With three quarters of all adults having access to SVOD, and audiences wanting to watch what they want, when they want, the competition amongst on-demand TV is ever increasing. So much so, that we are now seeing some of the digital players turn to ads to increase commercial minutage and revenue.

The likes of Disney and Netflix have already launched this, offering a lower cost subscription which includes ads. Amazon Prime is launching a slightly different model on 5th Feb, offering a higher cost subscription to view without ads. This could have a fantastic impact for brands trying to get in front of harder to reach light TV viewers.

Finally, despite the drop in TV and increase in digital video, the majority of this content is still watched on a big screen TV. 95% of VOD and 81% of SVOD is consumed on a TV screen. Even the likes of YouTube classes TV as the 2nd highest medium to watch content on after mobile.

To sum up, in 2024 we will continue to see huge weekly reach through AV and vast consumption on TV. However, this will transition to a wider AV reach with deeper targeting and more commercial benefit.

2. Growing sustainable Media

Caroline Shepard

No longer an emerging trend, but a topic that has continued to gather momentum and visibility across the industry is sustainability – understanding the impacts of and to a business, beyond financial implications.

For any advertising agency, carbon emissions fall into three ‘Scopes’. Scopes one and two are related to emissions generated by and for the business’s physical operations, Scope three is where media emissions show up, through the companies that facilitate the running of our media. This is the media supply chain.

The advertising giant WPP estimates that 98% of their carbon emissions are in ‘Scope three’ and of that figure, 55% come directly from the media bought by its media investment wing, GroupM, on behalf of its advertiser clients.

Sustainable media practices are those implemented to reduce carbon emissions at the media stage in the advertising process. On an industry-wide level this is very much rapid work-in- progress. Various working groups have been formed and tasked with devising recommended media owner supplier lists. These lists will highlight sustainable suppliers in the media value chain along with suggested industry frameworks and measurement tools.

This said, there are individual initiatives appearing all the time. For example, at IMA-HOME we actively search for sustainability measures within our media channels, such as in Print & Outdoor. We refine the digital sites and domains we recommend, using carbon reduction measures to lose the worst offenders on our digital plans, based on Scope three emissions.

This goes to show that sustainability measures can be considered – and actioned – immediately, to become part of day-to-day operations. Expect a lot more to come on this topic in 2024!

3. The rise and rise and rise of Retail Media

Suzi Kilka

Retail Media (advertising within a retailer or marketplace website/app) is booming thanks to the proximity to the shopper (brands can reach the customer whilst they’re already in shopping mode) and the first party data on offer (retailers have a deep understanding of their customers’ shopping behaviours on the platform).

Globally, it’s currently the fourth largest medium by ad spend after linear TV. It’s expected to grow to $142bn this year, having seen at least double-digit growth every year since 2014. This means it’s fast catching up with linear TV, as well as taking share from both paid search and paid social (the current top two channels).

As with anything that sees accelerated growth, there are some challenges…

-

There’s a lack of scale, apart from with Amazon, which whilst deemed the most desirable online retail environment, most of their business is with SMEs rather than big brands.

-

Standardisation - metrics and definitions vary so it’s hard to compare one against the other. But, just like display advertising did, it should iron out as the medium matures.

-

There’s no single view of what success looks like. However, last year ISBA (the UK Ad Trade Body) put together a “responsible media retail framework”, so hopefully we’ll see the retail media networks (RMN) start to align on this.

**So, what’s next? **

This year, we’re likely to see the consolidation of RMN and the breaking down of silos for both cross-channel measurement and collaboration. This will ease planning and buying challenges.

We also expect to see growth of different formats. The ability to target further up the funnel will improve, with the measurement of incremental ROAS, not just conversion. Plus, expansion to the open web will help in reaching audiences at scale.

And lastly, connecting first-party data to in-store. By updating tech and advertising in store to be more targeted and to better understand the link between online advertising influencing in store behaviour.

4. The year that the cookies finally crumble

Will Hughes

This marks the year where technology finally overtakes legislation in driving change within a privacy-centric internet.

Google are phasing out third-party cookies, and the ability to stitch users journey together across different sites and show the attributer view will be gone. But it’s not all negative.

It’s a new era for digital advertising. There are two approaches to this change. If everyone did as they were told, then we would need to track online advertising a bit like press. Or, the other option is to find ways to replace third party cookies.

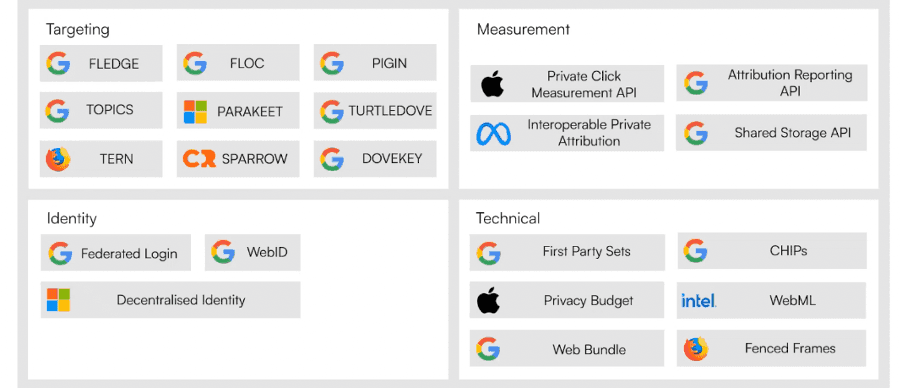

There are many projects underway (mainly driven by the major adtech companies) that aim to replace the different functionalities third party cookies gave us.

As you can see below, most of the projects have a Google logo next to them. This poses a massive conflict, because they stand to gain the most from essentially cornering the privacy market and telling you the performance of their ads. Regardless of the company behind it, all these ‘solutions’ need to be treated with a certain amount of scepticism, because they will try and use them to line their own pockets.

Despite the fact that cookies are being phased out now, not all of these projects are open betas – you can’t access all of them. At IMA-HOME, we’re busy testing those that are accessible, and Google’s Attribution Reporting API is the key one. This is how advertising is going to be measured moving forwards.

Without it, not only will ad campaigns struggle to perform, but the open web ecosystem will die. Advertisers like the Guardian are already reporting that ‘uncooked users’ (users that don’t have a cookie) are generating revenues between 30 – 50 % lower than those that are ‘cooked’. With that kind of drop in revenue, they will cease to exist. So, we could be seeing the end of the free internet, whereby everything sits behind a subscription model.

What does it mean for us?

As mentioned, Attribution Reporting API is going to be key, it’s the only thing that’s going to keep the open web in competition from the walled gardens.

We need to be continuously testing to make sure that what Google is telling us about performance, does actually add up. We’ll also be looking at all alternatives for targeting and first party data. This has been the core of our consultancy push over the last five years, to get all of our clients to think about how they can capture and process their own data to help targeting and their own measurement. We are also expecting to increase the conversations we’re having around econometrics and modelling techniques like MMM.

It may seem daunting, but 2024 is a really exciting time to be in digital media. It’s both going backwards and forwards at rapid speeds, and so being able to test and find the elements that sustain performance will be a brilliant challenge, and ultimately make brands stronger for it.

5. What’s ‘nOOH’ in OOH

Ben Cunningham

Both OOH and digital OOH (DOOH) have been ranking among the top five media channels in 2023, according to a study by Kantar. Interesting, all top five channels for consumers require people to ‘go out’. Sponsored events are leading for a second year, Cinema and POS are strong, and Out of Home – both traditional and digital – is making a big splash.

The last year has been a strong one for Out of Home, and as we look to 2024, the sector shows promise for continued growth and transformation. This is one media channel that is consistently evolving, whether that’s on creativity, data-driven strategies or technology-driven outcomes.

Here are a few themes we expect to play out in 2024…

DOOH is on the up

Digital OOH is predicted to grow 17% in 2024. This is driven by media owner investment in screens in the ground and a 30% increased investment in programmatic OOH. This is potentially influenced by the death of the cookie.

Unleashing creative potential

Over the past year, we have seen significant developments in creative DOOH. From AR and VR to 3D and AI. In 2024, brands will begin to realise the possibilities and potential of these developments to engage audiences, build brand fame, trust and share as well as achieving significant ROI improvements vs static formats.

OOH as an omnichannel approach

We’re predicting clients will adopt OOH as part of an omnichannel approach. This ensures that brands maintain consistency in their messaging, creating a cohesive experience across different touchpoints. In particular, DOOH is expected to become more integrated with social media marketing. By doing this, advertisers will widen their reach and achieve standout that is harder to achieve purely online.

Connected strategies

The role of OOH within the Retail Media ecosystem will continue to gain momentum. DOOH in particular will become a pivotal player in every shopper marketing strategy. With 75% of all purchases still being made in physical shops, but most retail media opportunities being currently online, there is a huge opportunity for proximity DOOH to be more connected, targeted and addressable, capitalising on access to retailer’s first party data.

With continued developments, the roll-out of in-store digital screens in major grocery retailers and the continued growth of online retail media and ecommerce, we expect to see new opportunities for advertisers to create value in this space.

If you have any questions for our media experts, get in touch with the team at [email protected].